Condo Insurance in and around Williamstown

Unlock great condo insurance in Williamstown

State Farm can help you with condo insurance

Home Is Where Your Heart Is

When you think of "home", your condo is first to come to mind. That's your home base, where you have made and are still making memories with your favorite people. It doesn't matter what you're doing - taking it easy, cooking, unwinding - your condo is your space.

Unlock great condo insurance in Williamstown

State Farm can help you with condo insurance

Why Condo Owners In Williamstown Choose State Farm

We get it. That's why State Farm offers awesome Condo Unitowners Insurance that can help protect both your unit and the personal property inside. Agent Carolyn Thomas Thompson is here to help you understand your options - including benefits, savings, bundling - helping you create a customizable plan that's right for you.

Ready to get going? Agent Carolyn Thomas Thompson is also ready to help you discover what customizable condo insurance options work well for you. Reach Out today!

Have More Questions About Condo Unitowners Insurance?

Call Carolyn at (859) 824-5054 or visit our FAQ page.

Simple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

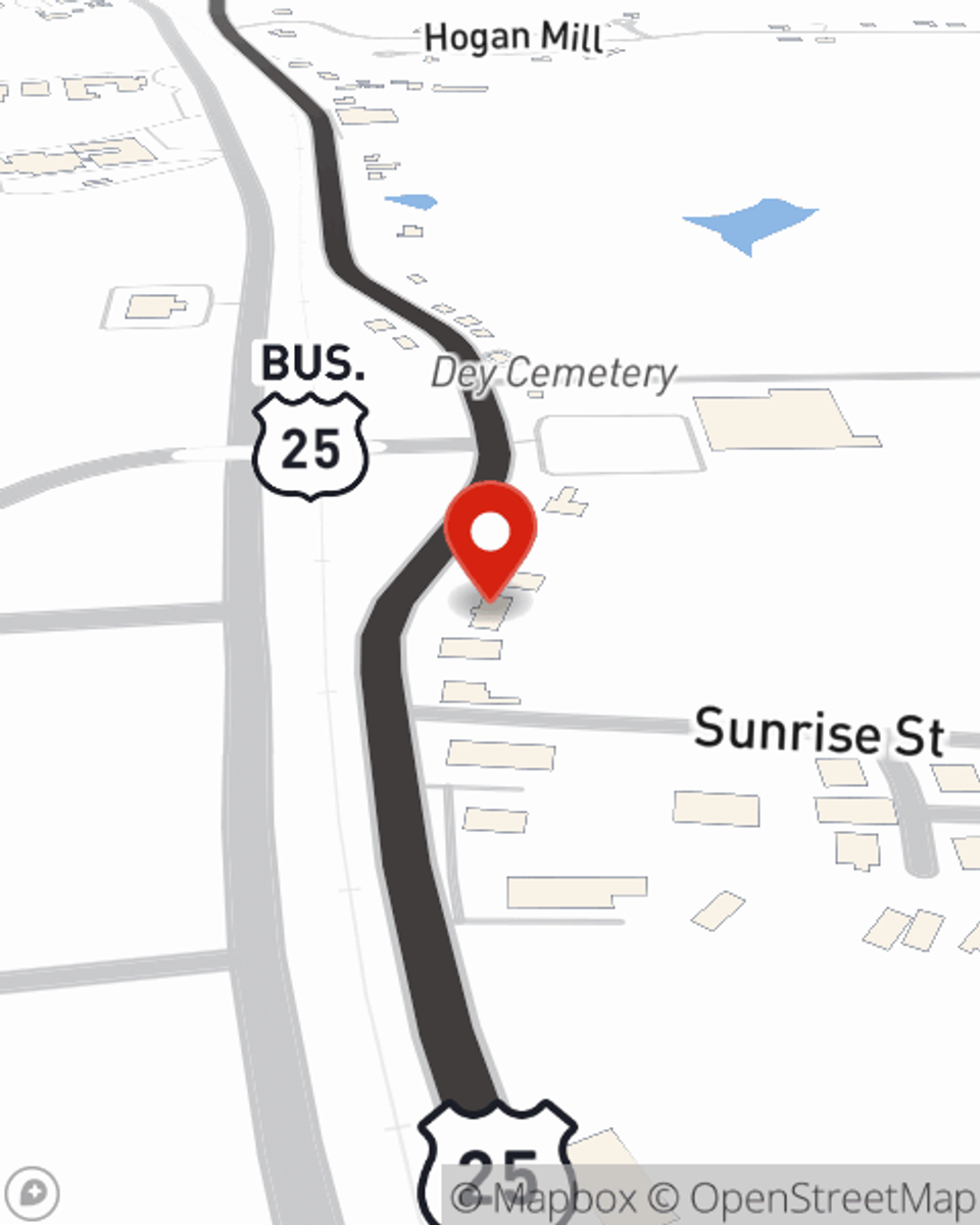

Carolyn Thomas Thompson

State Farm® Insurance AgentSimple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.